Posted on January 3, 2023

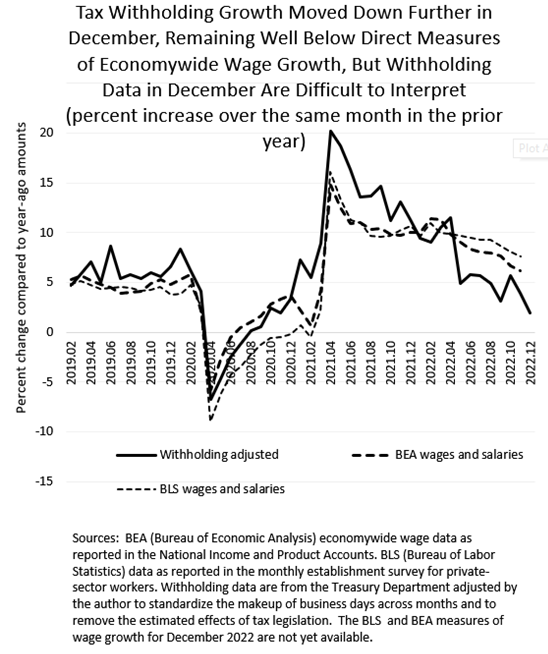

We estimate that growth in federal tax withholding–amounts of federal income and payroll taxes withheld from workers’ paychecks and remitted by employers to the U.S. Treasury–fell further in December, registering 1.9 percent growth (compared to amounts from December of a year-ago). That represents a continuation of a gradual diminishing of growth since April 2022 (see chart below). However, tax withholding in December and January is always difficult to interpret because of year-end bonuses, which are highly variable and tend to go to higher-income individuals; the concentration of bonuses among higher-income taxpayers, who face higher income tax rates, means that they can break the link between withholding growth and economywide wage growth. Given the reported recent drop in year-end bonuses in the financial and housing sectors, it would not be surprising for economywide withholding growth to slow, and by more than economywide wage growth.

And on top of the uncertainty from year-end bonuses, withholding payments in December also contained the second (and final) installment of withholding that had been deferred from 2020, as allowed by the CARES Act (see previous post). The amounts of such payments, as best we can infer, look to be roughly in line with the amounts paid last December, which makes sense given that one-half of the deferred amounts were due to the Treasury by the end of last year and the other half by the end of this past December. Although we adjust the estimates of withholding growth to remove the estimated effects of law changes (such as those payments of deferred amounts), the magnitude of the deferred payments cannot be directly measured and thus our estimate of withholding growth adjusted to remove the effects of law changes is also uncertain. Except for those payments of deferred taxes, we currently are making no adjustments to withholding growth to reflect changes in tax law, because the tax laws that directly affect withholding amounts have not changed in more than a year.

The growth in direct measures of economywide wages and salaries has been above withholding growth in recent months (again, see the chart below). In recent months through November, we have observed withholding growth being exceeded by economywide wage growth as measured both by the Bureau of Labor Statistics (in its monthly establishment survey of private-sector workers) and by the Bureau of Economic Analysis (BEA, in the National Income Accounts). The wage measures for December are not yet available. It has been difficult to tell if revisions to the wage measures, mainly to the better measure from BEA, will occur in the future, or if average tax rates have fallen and thus caused withholding growth to fall independently of wages, or if something else is going on. In any event, the withholding data for December don’t provide much help in understanding the sources of the wage/withholding growth difference.