Posted on November 9, 2021

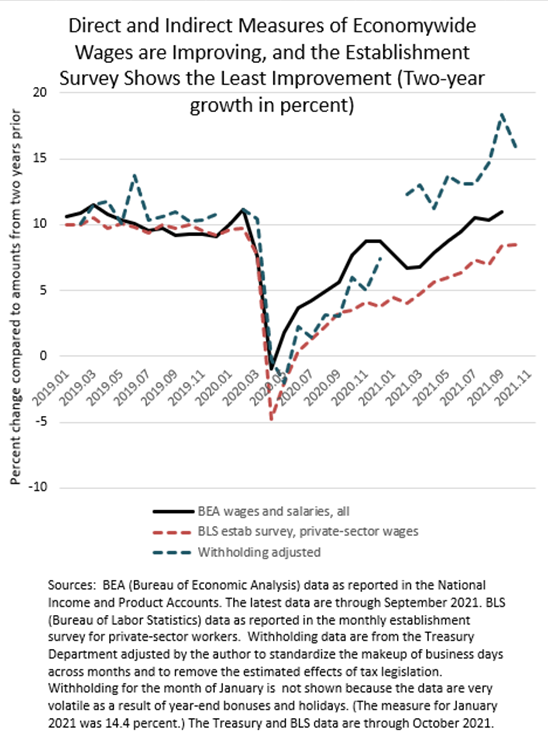

The Bureau of Labor Statistics (BLS) released its monthly establishment report last Friday, showing unambiguously that employers added many jobs in October, and also more than its preliminary estimates for August and September. That’s good news. Regardless, the establishment report is showing the least amount of increase in wages among the most current measures that we track: it showed economywide private-sector wages and salaries in October rising 8.5 percent above the amount from October of two years ago, about the same two-year growth as in September and still below the two-year growth recorded through 2019 and early 2020, before the pandemic (see chart below). (We look at two-year growth to avoid the difficult-to-interpret one-year growth that is currently inflated by the low starting point in 2020.) However, economywide wages and salaries as measured in the National Income and Product Accounts (NIPAs) are probably a better measure, and they have rebounded to about 11 percent two-year growth in September, the latest month available. That is at or slightly above two-year growth from before the pandemic. The NIPA measure is probably a better measure of economywide wages and salaries because it includes amounts from irregularly-paid bonuses, as well as gains from stock option exercises, both of which are excluded from the BLS measure. Those excluded amounts are skewed toward higher-income workers.

Income and payroll tax withholding from paychecks, which over a long period of time has correlated closely with those two direct measures of wages and salaries, shows substantially more growth, several percentage points higher than even the NIPA measure, as we have discussed in other posts, including our post about withholding in October. We believe that distributional shifts in wages, with higher-income workers doing much better than others through the recession and recovery, have boosted tax withholding well above wage growth–basically representing an increase in average tax rates in the economy. Another possibility is that wages and salaries for 2021 in the NIPAs will be revised up next summer to be closer to withholding growth. The partial release next week and full release in early December of the Quarterly Census of Employment and Wages for 2021Q2, which becomes the main source data for the NIPAs and can cause major revisions, may give us some indication of that possibility, but we’ll really need the 2021Q3 value, to be released three months from now, to get a better handle on the potential for future NIPA revisions.