Posted on November 14, 2020

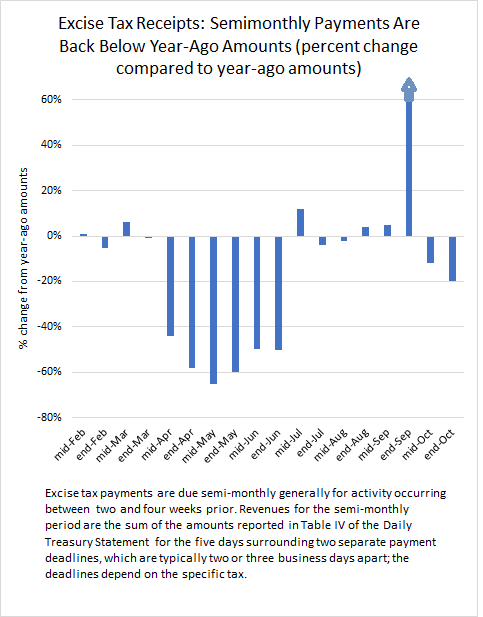

Excise tax collections have been down and up since the pandemic hit, mainly down (see chart below). The movements have resulted from legislative and administrative changes, along with the economic contraction. Collections have moved back down in the past month following a temporary boost from payments of deferred alcohol and tobacco taxes, along with one-time payments of a health insurers’ tax at the end of September. But I get ahead of myself. It’s perhaps best to just break the movements into specific periods.

First, though, let me start with a little background. Federal excise taxes typically account for only about 3 percent of total federal revenues. Although there are more than 50 separate excise taxes, the overall revenue is concentrated in a few types of taxes: much of the revenue (normally almost half) comes from highway-related taxes, with about two-thirds of that from taxes on gasoline production. The other main sources are aviation-related (mainly the air passenger ticket tax), which account for about 20 percent of total excises in a normal year; and alcohol and tobacco taxes, which combined account for about 25 percent of total excise tax revenue. I should note that, although the Treasury Department largely knows the total amount of excise tax payments within a day of the collection, which they then report in the Daily Treasury Statement, they do not know the components of total excise payments except with a lag of several months. The assessment of the components for recent quarters can only be done by inference.

So, what explains the down, recovery, and down again movements in excise collections since the pandemic hit in full force in April?

- Revenues were way down through June, as we posted back then, reflecting several factors: 1) aviation-related taxes were suspended for the calendar year starting in late March by legislation (the CARES Act), and they were going to be way down regardless given the huge drop in air travel; 2) the IRS through administrative action allowed tobacco and alcohol excise tax payments to be deferred until July; and 3) gasoline taxes were way down because of reduced driving (more on that later).

- Revenues from July through mid-September were up slightly overall mainly because deferred alcohol and tobacco taxes were allowed to be paid gradually over a period of about three months. Those deferred payments, on top of the normal alcohol and tobacco tax payments, presumably roughly offset the declines from suspended aviation taxes and lower gasoline tax collections.

- At the end of September, the on-again, off-again excise tax on health insurers–established by the Affordable Care Act–was paid for the last time; it has been eliminated now going forward. In years when it was on, the tax payments were due once per year at the end of September. It was temporarily turned off in 2019, thus the end-September 2020 payments boosted total excise collections substantially (about 175% higher for the end-September payment) compared to the comparable period in September 2019.

- Starting in October, excise tax collections have been back down again. Without the temporary boost from payments of the deferred alcohol and tobacco taxes and the health insurers’ tax, the main effects are presumably the continued loss of aviation taxes, so about a 20 percent decline (all of its normal share of total excises), and weaker collections of gasoline excise taxes, which normally account for roughly one-third of total excise tax collections. Gasoline production, the source of the gasoline tax, has recovered since April, but has still been down by about 10 percent since July, compared to the same period of a year ago (see chart below, using data on gasoline production from the Energy Information Administration that, among the various quickly-available measures available, I assess as moving most closely with the federal gasoline tax base). My rough accounting would explain total excise collections recently being down by about 23 percent–20 percent from aviation-related taxes and 3 percent (10 percent of one-third) from the gasoline tax; that is close to the 20 percent reduction in total excise tax collections at the end of October (see first chart above). Doubtlessly other, smaller sources of revenues are moving around as well.

For a last thought, if I were still in the business of projecting federal tax revenues, I’d be hard-pressed to expect much more recovery in gasoline production, and hence gasoline tax revenues, in the near term, as the country goes through another COVID-19 wave. That somewhat steady 10 percent decline in gasoline production since July doesn’t bode well for the federal Highway Trust Fund, which is largely financed by taxes on motor fuels, mainly gasoline. A major question going forward is whether gasoline consumption will be down, relative to what was projected pre-pandemic, even when the economy has largely recovered; there is certainly the potential for a shift, perhaps permanently, to much more teleworking, which would reduce driving commutes.