Posted on March 2, 2023

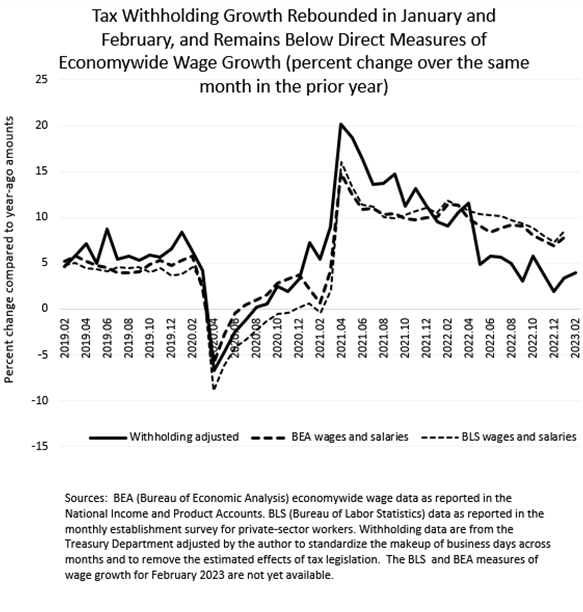

We estimate that growth in federal tax withholding–amounts of income and payroll taxes withheld from workers’ paychecks and remitted to the U.S. Treasury–grew by 3.9 percent in February compared to the amount from February of a year ago (see chart below). That is the same growth recorded in November of last year, before a drop in December and subsequent rebound the past two months. The drop in December could have reflected weak year-end bonuses, a temporary phenomenon, although measurement of tax withholding in December was complicated by tax law changes particular to December 2021 and 2022 (see previous post). Our measure of tax withholding is constructed by taking the actual amount of withholding reported daily by the U.S. Treasury and then adjusting those data to remove the estimated effects from tax law changes and to standardize the calendars across months. (Note that the format of the Daily Treasury Statement changed substantially in mid-February, but all the tax data are still there. If you, like me, have programs to pull down the data automatically, I hope it doesn’t take too much effort to adjust.)

Despite the increase in withholding growth in February, it remains well below the growth measured for economywide wages and salaries from both the Bureau of Economic Analysis (in its monthly GDP accounts) and the Bureau of Labor Statistics (in its monthly establishment report of private-sector workers). Those data, especially the BEA measure, are subject to revision and are lagged. We get the BLS employment report for February on Friday, March 10.

We’ll see if the further rebound in withholding growth in February will be reflected in a strong employment report for February. However, the number of jobs, the headline number from the employment report, is just one factor contributing to the amount of tax withholding. Other factors include average hourly earnings and the average number of hours worked per week. (Multiplying the number of jobs by average hourly earnings and the average workweek yields the amount of economywide wages for a week.) Also, changes in the distribution of income can cause differences between growth in tax withholding and wages.