Posted on December 3, 2020

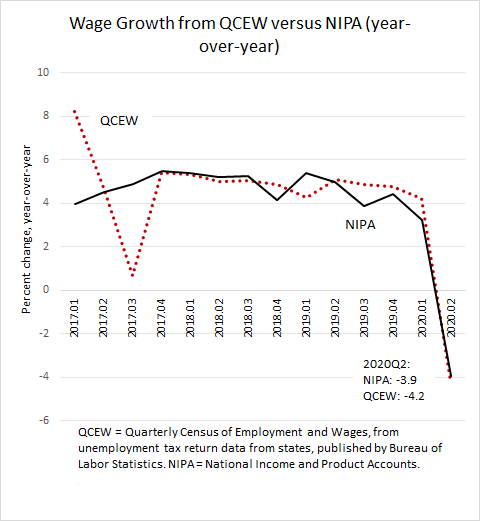

Sometimes it’s perilous to project National Income and Product Account (NIPA) wage revisions based on the incomplete wage data from the Quarterly Census of Employment and Wages (QCEW). And when the economy is in major upheaval is one of those times. Two weeks ago we posted about the incomplete QCEW data for the second (April-June) quarter of 2020, and guessed (and we put a question mark in the title) that the NIPA wage data, which are eventually based largely on the QCEW, would be revised down some. Well, wages in the NIPAs were revised up some instead, and we can see why from the subsequent release yesterday of the full QCEW data (which had been incorporated into the NIPAs even though the QCEW data weren’t publicly available yet). The QCEW data on total wages and salaries in the economy, which come from employer tax filings with states for purposes of the state and federal governments administering the unemployment insurance program, were down by 4.2 percent for the second quarter compared to the amount in the second quarter of 2019. The latest NIPA wage amounts, which were released on the Wednesday before Thanksgiving, showed wages and salaries down by 3.9 percent for the quarter on the same year-over-year basis (see chart below). So, the two measures of wages and salaries lined up pretty well, which is usually the case because the QCEW provides the underlying source data for the NIPA wage measure. However, they don’t always line up given that adjustments are made to the NIPA data to reflect estimated calendar differences between years (the QCEW data aren’t so adjusted) and because the NIPA data have to fill in some gaps for the small share of workers who are not subject to the unemployment insurance system.

We were wrong in thinking that NIPA wages for the second quarter were possibly about to be revised down because we estimated that QCEW-measured employment for April and May, which were (as always) missing from the initial, incomplete data, would match the change in what the Bureau of Labor Statistics reported in its monthly establishment survey. But, the full QCEW data showed that employment didn’t drop quite as much as BLS measured in the establishment survey. As a result, we had expected QCEW wages to be down by 4.9 percent for the quarter rather than the 4.2 percent shown with the complete data. Since wages in the NIPAs for the second quarter had been down, pre-revision, by 4.6 percent, we inferred that lining up the NIPAs with the QCEW would result in a small downward change to the NIPA wages. But instead the QCEW was stronger than we expected, and the NIPA wages moved up as a result. That’s the way it goes. It is good news that wages were slightly stronger than other measures showed, although there is no perfect measure of economywide wage amounts.

Of course, this is all about the second quarter, now somewhat ancient history. We have a prior expectation that NIPA wages currently measured for the third quarter seem a bit strong compared to both wage data from the establishment report and tax withholding data. But making that case will take some effort, for some other time. We will be game to give NIPA wage revision forecasting another go.