Posted on July 8, 2020

Summary

- Several tax payment delays end in just a week, on July 15, so that should be a very big day for federal tax payments. Much of that will get recorded by the IRS over the second half of the month. The biggest amounts will result from many taxpayers filing their 2019 returns and paying the amounts due.

- I wouldn’t be surprised if total receipts this month look a lot like April receipts typically do, even though more than just payments normally due in April have been delayed. Quarterly estimated payments delayed from June to this month should drop off significantly because of the recession, and in addition not all taxpayers have taken advantage of the various payment delays.

- Even with tax payments in July perhaps looking much like a normal April, I’m worried about the effects on the economy and financial markets. After all of the liquidity added to the economy by the Federal Reserve and policymakers, this will be the first notable removal of funds from the system since the pandemic hit, and the question is how well the economy can handle it.

July 15 is shaping up to be a supercharged day for federal tax payments. The Treasury Department decided not to further extend the three-month delay already provided for filing individual tax returns for 2019, so July 15 is the deadline to file and pay. The Treasury Department also delayed until July 15 the first two quarterly estimated payments of individual and corporate income taxes, which were originally due on April 15 and June 15, as well as the due date for the corporate income tax payment for 2019 also originally due on April 15. Altogether, it could be a very large amount of tax payments concentrated in mid-July (some of which gets booked over the second half of the month as the IRS processes tax returns for 2019). I wouldn’t be surprised if a drop-off in quarterly payments and some other factors make the total amount for the month look a lot like a normal April, typically the biggest month for federal receipts. I am worried about the potential effects of the large tax payments on consumer spending and financial markets given the current problems in the economy.

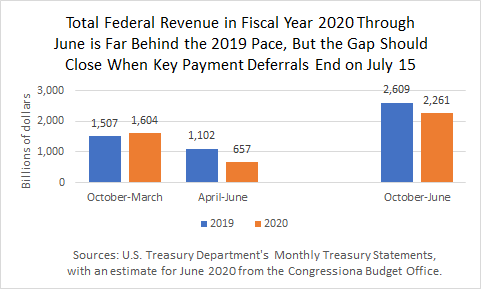

So, how much in the way of taxes are we talking about? First, tax receipts from April to June have been paltry, consisting mainly of withholding from workers’ paychecks for income and payroll taxes. Total receipts were down by about 40 percent, or about $445 billion, in the past three months, compared to the same period from a year ago (see chart below). That was after an increase of 6 percent, or almost $100 billion, in the first half of the fiscal year from October to March. Thus, nine months into the federal fiscal year, revenues are down by about 13 percent, or almost $350 billion. (I’m using estimates for June receipts from the Congressional Budget Office in its Monthly Budget Review.)

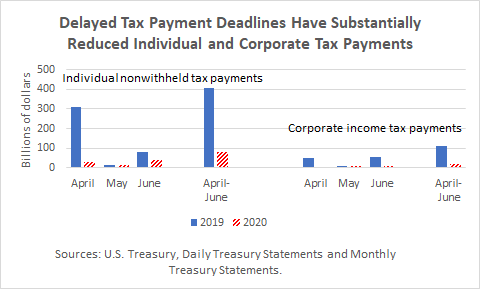

It seems clear that much of that overall revenue drop from April to June was from the payment delays and thus will be made up this month. I tally that the main revenue sources with payment delays were down by over $400 billion from April to June of this year compared to the same period last year. Most of that is from individual nonwithheld income tax payments, which consist of final payments for 2019 activity with tax return filings as well as quarterly estimated payments. They were about $400 billion from April to June 2019, but only about $80 billion in the same period this year (see chart below). That’s a $320 billion drop. And gross corporate income tax payments, largely from quarterly payments of taxes for 2020 but also including some final payments for 2019, were about $110 billion from April to June 2019, and only about $20 billion in the same period this year: there’s another drop of $90 billion or so. Together, those two sources of revenue were down roughly $410 billion in the past three months. Other much smaller sources of revenue also received some payment delays to mid-July, such as estate and gift taxes and most excise taxes (see previous post for a discussion of the excise tax delays, which are not a simple one-time shift). The end of those delays shouldn’t affect overall receipts in July very much.

One way to look at receipts in July is that on July 15 the Treasury Department will be receiving a big chunk of tax payments normally due in April from individual and corporate taxpayers, plus the major quarterly tax payments due in June. Will that be big enough to slow consumer spending and even weaken financial markets as higher-income taxpayers have less liquidity for investments?

Maybe not, because I wouldn’t be surprised if the July tax payments end up being in the vicinity of a normal April, and the economy is normally able to withstand the big tax payments in April. My math begins with the fact that tax receipts in a normal July for the delayed revenue sources are quite low: last July payments of corporate income taxes and nonwithheld individual income taxes were together only about $20 billion, so the main question is how much of a bump do receipts this July get from the payment delays. Even adding to July receipts all of the reduced revenue between April and June from the tax-delayed sources, the $410 billion, would put revenues from those tax sources at about $430 billion. That would be bigger than In April of 2019, when individual nonwithheld payments plus corporate income tax payments were about $360 billion. But I would expect quarterly estimated payments to be much lower this year given the recession. Factoring in that potential weakness and continued weakness in withholding taxes, my math is that overall gross receipts (before accounting for refunds) being in line with those from last April is plausible. Of course, receipts in April are very volatile from year to year, so that means it could be very hard to project accurately how big receipts will be this month. As an aside, one thing I will leave to others is whether certain seasonal adjustment factors get messed up by having major income tax payments being made in July rather than April. For example, perhaps consumer spending normally weakens some in April because of tax payments, but the data get seasonally adjusted so we don’t see the weakness; now that effect would hit in July, and the normal seasonal factors won’t compensate. Fortunately stock market prices don’t get seasonally adjusted.

Although July tax receipts could end up looking a lot like a normal April, even with the extra quarterly payments, the problem is that this is not a normal year. After the unprecedented liquidity added to the economy by the Federal Reserve as well as by policymakers in the CARES Act and other legislation, I believe this will be the first notable removal of funds from the economy since the pandemic hit. Cash constrained consumers could pull back more after making their tax payments. Some taxpayers may need to investigate installment plans with the IRS for the first time. It also appears that the outstanding amount of individual refunds from 2019 tax filings is much lower now than it normally is in April just before the filing deadline, so the boost to consumers from obtaining those refunds this month won’t be as large as in a normal April (with the flip side being a bigger boost in July to federal receipts net of refunds). In addition, investors could sell stock or pull money out of bonds as a result of their tax payments this month. And all of that occurs while some state and local governments have started pulling back from economic re-openings as COVID-19 cases and hospitalizations have increased. That all worries me.