Posted on December 30, 2020

Happy New Year, everyone. In short, the end of the calendar year means that we’ll be using new estimates going forward of the effects on withholding of legislative changes. Primarily because of the expiration of two payroll tax deferral provisions this week, our estimated legislative effects will be changing starting in January. Basically, for the period from January through March 2021, we estimate that recent tax law and administrative actions will be reducing withholding by about 0.8 percent compared to year-ago levels, a relatively small effect. That is much lower than the 4.0 percent decline we estimated from April to mid-September 2020, and the 4.6 percent decline from mid-September to the end of calendar year 2020. There will be further changes come April 2021, but let’s just bite off the January-March period in this post.

As we have said many times, in order to make our estimates of tax withholding growth useful in tracking the economy, we adjust the withholding data to remove the estimated effects of recent legislation–that which directly affects withholding amounts but not wages and salaries. That allows us to measure withholding growth on a constant law basis that we can relate to growth in the amount of overall wages and salaries in the economy, the most important determinant of the amount of tax withholding.

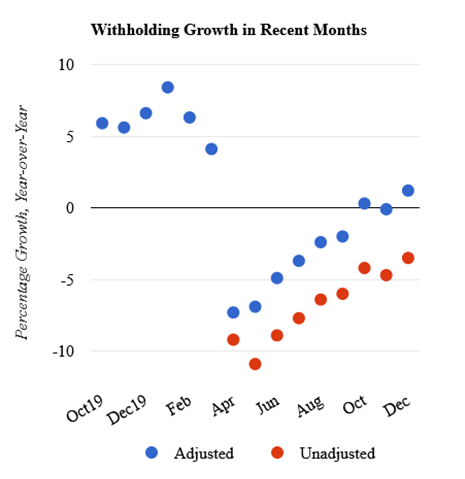

Since March, when policymakers enacted the CARES Act, along with earlier legislation that month dealing with family and sick leave tax credits, we have estimated that overall withholding has been reduced as a result of the legislation. We estimated that withholding had been reduced by about 4 percent from April through mid-September 2020 as a result of the March legislation, largely from the employee retention tax credit and the employer-side optional Social Security payroll tax deferral from the CARES Act, and by about 4.6 percent starting in mid-September when the employee-side Social Security payroll tax deferral option was added on by executive action. Those effects can be seen in the chart below on growth in withholding in recent months, in which unadjusted withholding growth (basically using the raw daily data from the Treasury Department, measured by us to reflect comparability of business days across months) always ran below the adjusted (constant law) measure. Since the law changes reduced withholding, we add that estimated amount back to the true withholding amounts in order to estimate constant law withholding growth. That difference between the unadjusted and adjusted amounts will be tightening starting in January–absent further law changes, of course, but nothing affecting withholding seems to be percolating in Washington.

We have opined previously about our withholding legislative adjustments for the CARES Act and other March provisions and the August executive action. One of the main CARES Act provisions affecting withholding, the employer-side Social Security payroll tax deferral, expires this week. Employers who opted into the deferral will need to begin remitting the full amount of those taxes again to the Treasury. They don’t need to remit the deferred amounts themselves for many months–half by the end of December 2021 and the other half by end December 2022–but the end of the deferral itself means that withholding will stop being reduced for that reason like it has been since April. Since there was no deferral from January through March of 2020, before the CARES Act took effect, that means that we need make no associated adjustment to withholding growth from January to March 2021–because our year-over-year growth measure compares the effect in the current year (0 for the first quarter of 2021) to the previous year’s same period (also 0 effect).

The Consolidated Appropriations Act, 2021, signed into law by the President this week, among its many provisions does extend and enhance the employee retention tax credit (ERTC), which was initially enacted in the CARES Act and reduces withholding remittances. The Joint Committee on Taxation (JCT), the Congressional estimators of the revenue effects of law changes under consideration by lawmakers, didn’t have much to go on back in March when they made their estimate of the revenue effects of the original ERTC, and the JCT estimated a very large effect. (See the first business provision on page 1 of the JCT table; a later revision to the bill’s estimates didn’t change the ERTC estimate). For a variety of reasons we have been estimating that the actual effect was much smaller than JCT’s original estimates, and the JCT’s estimate of the extended/expanded version enacted this week was indeed much smaller than their earlier estimate of the ERTC. It looks like JCT is estimating something on the order of a 1 percent reduction in total withholding from the new ERTC, which is in effect for the first six months of 2021. Presumably the JCT now has some actual data on usage of the ERTC in 2020 that suggested lowering the estimate substantially. (It’s hard to compare the new JCT estimate with the original provision, given the more generous provision now but with much lower amounts of unemployment. But the expansions of the ERTC look more significant than the reductions in unemployment, implying that technical revisions have lowered their estimates.) That estimated 1 percent decline from the new ERTC provision, which we are using, is the main source of our estimate of a 0.8 percent decline in withholding from January-March 2021 compared to the same period in 2020.

The other part of our estimate for the January-March 2021 tax law effects on withholding, a small 0.2 percent increase in withholding, stems from the unwinding of the executive action announced back in August and modified by the Consolidated Appropriations Act, 2021. We estimated that the option to defer employee-side Social Security payroll taxes was taken up by few firms, amounting to about a 0.6 percent reduction in total withholding from mid-September to the end of December 2020. The original executive action required electing employers to not only stop the deferral at year’s end, but to remit the deferred amounts ratably over the first four months of calendar year 2021, basically increasing workers’ withholding taxes over that period. The Consolidated Appropriations Act, 2021, extended the repayment period to the full calendar year, so the same amount will be repaid but just not all crammed into the January-April period. The math works out that 3.5 months of a 0.6 percent withholding reduction in calendar year 2020 equals 12 months of just about a 0.2 percent increase in withholding spread over the full calendar year 2021.

Things will get more complicated for our legislative adjustments come April, when we have to account for the CARES Act provisions taking effect in April of 2020. If provisions permanently raise or lower revenue amounts, then we start having no adjustment to our withholding growth measure a year later–because the percentage higher or lower revenues will be the same in both the current year and the prior one, so the growth rate in revenues would be largely unaffected. (See our methodology page for more details.) But that’s not what’s happening, so new legislative adjustments will commence starting in April of 2021.