Posted on April 18, 2024

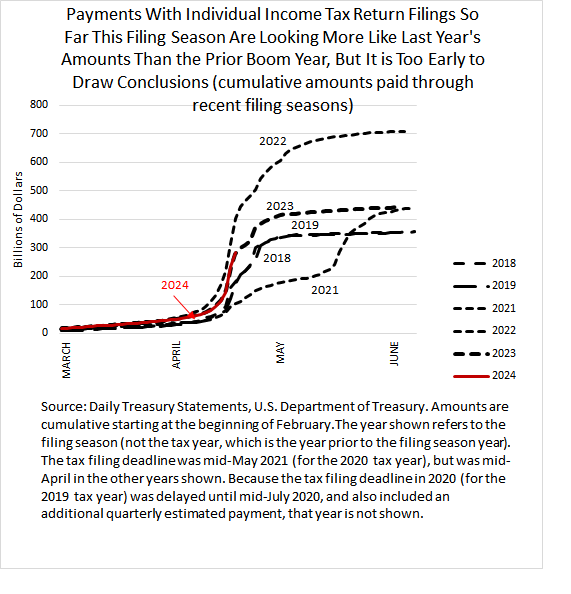

The due date to file federal income tax returns was Monday of this week for most individuals, and the IRS is busy tabulating the amounts paid with those returns, both from electronic payments and good old-fashioned checks (and, yes, from the multiple other available methods). It typically takes the IRS until the end of April and into early May to finish the processing of timely-filed returns. For the filing season through Tuesday, April 16, amounts tabulated are running very close to last year’s amounts at this same time (see chart below), but it is too early to draw conclusions. Last year at this time about two-thirds of amounts had been tabulated, but the speed of processing by the IRS varies significantly from year to year. The amounts are running well behind the pace of two years ago, when payments jumped significantly as a result of large increases in the stock market and the economic recovery following the pandemic. An unusually-high number of delays in payment deadlines allowed last year for taxpayers in disaster areas, more extensive than allowed this filing season, means that we would normally expect some increase, on the order of 5 percent to 10 percent, in payments with tax returns this April compared to those payments last year, even if the total amount of payments were ultimately the same.

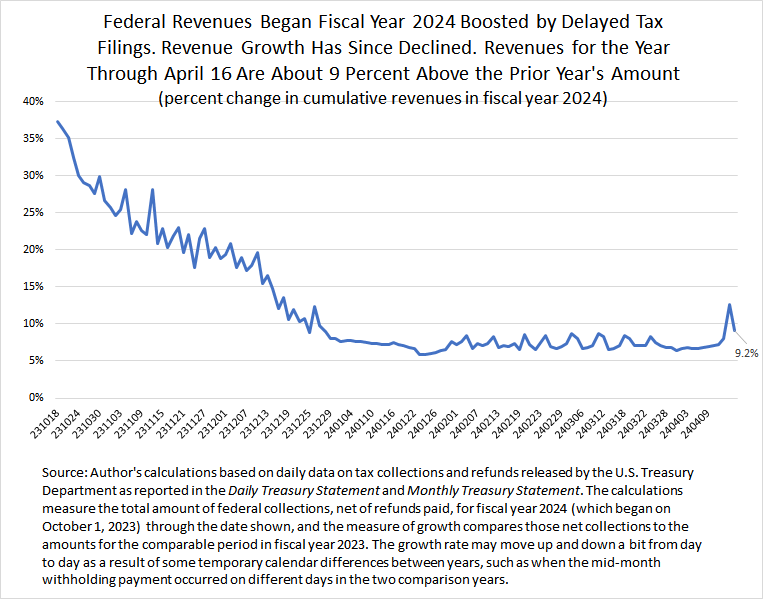

We estimate that growth in total federal revenues–from individual and corporate income taxes, payroll taxes, and other sources of revenue–has ticked up as a result of the receipts tabulated around the tax deadline. That includes a move up in corporate income tax receipts in mid-April, along with a move up in tax withholding amounts this month. We estimate that total federal revenues for the full fiscal year through April 16 (with the fiscal year beginning on October 1) are running about 9 percent above revenues through the same point in the prior fiscal year (see chart below). Revenues for the full fiscal year had been running about 6 percent to 7 percent above the prior year’s amounts from mid-January to the first part of April. That 9 percent growth estimate for the fiscal year through April 16 is very rough, because the large amounts being tabulated from income tax returns vary significantly day by day, and the percentage increase is significantly affected by the day of the week at the end of the period. At this point, even with the recent move up in growth, total revenue growth is falling short of the 11 percent to 12 percent growth for the full fiscal year projected a month or two ago by federal government revenue estimators at the Congressional Budget Office and the Treasury Department (assuming no tax law changes are enacted in the coming months that would affect this year’s revenues). But with almost half of the fiscal year remaining, and with the total amounts from income tax filings still very uncertain, revenues could certainly reach or even exceed those projections.