Posted on January 3, 2024

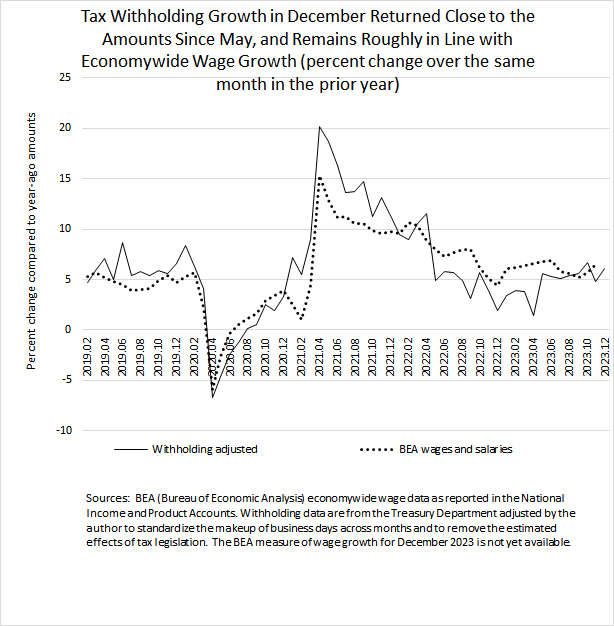

We estimate that federal tax withholding–the amounts of income and payroll taxes withheld from workers’ paychecks and remitted daily to the U.S. Treasury Department–grew by 6.1 percent in December after we remove the estimated effects of law changes. That growth is relative to the amounts of withholding in December 2022, measuring so-called year-over-year growth. That growth in December was close to the average of 5.6 percent growth recorded per month since May 2023 (see chart below). Because withholding tends to move with economywide wages and salaries, which in turn reflect movements in the overall economy, we do not see signs of an economic slowdown in the withholding data.

It is important to note that withholding growth for December is harder to measure than it is for other months because of law changes and year-end bonuses. First, in deriving our estimates of withholding growth, we remove the estimated effects of law changes that affect withholding but not wages and salaries. In this case, we adjusted withholding amounts for December 2022 to remove the effects of the second (and final) installment of payroll tax amounts that had been deferred from 2020, as allowed by the CARES Act that was enacted in 2020 (see previous post). The amounts of withholding in December 2023 actually fell compared to the raw, unadjusted amounts in December 2022, by around 11 percent, but that decline stemmed from the amounts deferred and paid in December 2022 that were not repeated this past month. We remove the effects of those deferred amounts in estimating the 6.1 percent growth in withholding in December, allowing us to more accurately gauge the movements in wages and salaries. Although we can estimate how much those deferred payments were in 2022, we cannot get a direct measurement, adding some uncertainty to our estimate of 6.1 percent growth on a constant law basis.

In addition, year-end bonuses make it more difficult to interpret December and January withholding amounts. Year-end bonuses are highly variable and tend to go to higher-income individuals who face higher than average tax rates; those bonuses can thus break the link between withholding growth and economywide wage growth.

Tax withholding in recent months has been roughly tracking recently-available data on economywide wages and salaries (again see the chart below). The data on economywide wages and salaries for December from the Bureau of Economic Analysis don’t become available for more than three weeks, but we don’t expect any significant shifts.