Posted on Tuesday, September 6, 2022

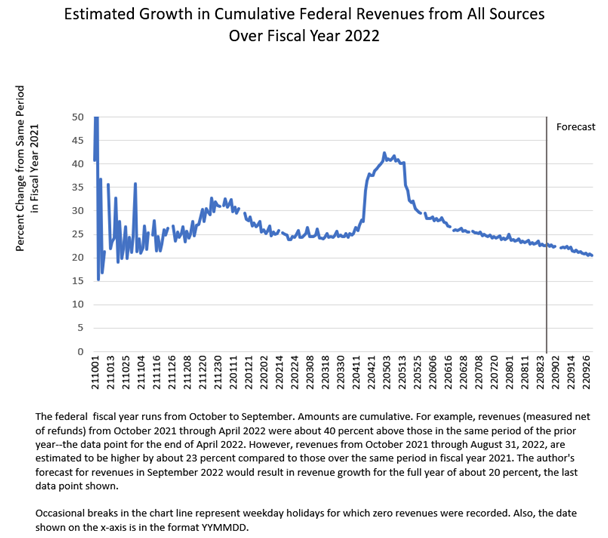

Federal revenues have boomed in fiscal year 2022, despite an economic slowdown that has seen real GDP growth turn slightly negative in the first and second quarters of this calendar year. Receipts in September, the final month of the fiscal year, include the third quarterly estimated payments for tax year 2022 by individuals and corporations, along with the daily, substantial remittances from employers of income and payroll taxes withheld from paychecks. Based on our forecast for September of those estimated payments and the rest of tax collections, we expect that total federal revenues will end the fiscal year up by about 20 percent–more precisely somewhere between 20 percent and 21 percent. That rapid growth would be the highest since 1969, and would be on top of the similarly rapid 18 percent growth in 2021.

Revenues in fiscal year 2022 were boosted significantly in April from strong final payments of individuals with tax return filings (see previous post). The due date for individual income tax returns was in mid-April 2022, compared to mid-May in 2021, so that year-over-year growth was temporarily boosted in late April and the first half of May compared to year-ago amounts; but revenue growth remained elevated after late May when the different filing deadlines no longer affected the comparison (see chart below that measures cumulative revenue growth over the 2022 fiscal year). After May, income and payroll tax withholding, which combined make up the bulk of federal revenues, has slowed to about a 7 percent rate of growth (measured on a year-over-year basis, and including the effects of law changes), much slower than earlier in the year and slowing the growth of overall revenues. Quarterly payments by individuals and corporations also slowed substantially in June (see previous post about corporate tax receipts). Assuming that growth in those quarterly payments doesn’t rebound in September, and that withholding continues to grow at its recent rate, we estimate that overall revenues will end the fiscal year about 20 percent to 21 percent higher than in 2021 (see the endpoint on the chart below).

If our estimates are correct, revenues in fiscal year 2022 would total in the neighborhood of $4.88 trillion, which would be only $40 billion to $45 billion higher than the Congressional Budget Office (CBO) projected back in May for the full fiscal year. That would represent a very close projection by my former colleagues at CBO, considering that they probably did not have complete information from the amount of tax collections in late April and early May, and given the considerable uncertainty of the effects of recent tax law changes and the amount overall economic activity. Our expectation for FY22 revenues is about $60 billion to $65 billion less than the amount projected by the Treasury Department and the Office of Management and Budget in the recently-released Mid-Session Review. There is still considerable uncertainty about tax collections even for a month, and we’ll see if the September quarterly payments increase enough to get revenues as high as the Administration projects.

Some of the strong growth in revenues in fiscal year 2022 represents the effects of tax law changes, such as the payment of certain payroll taxes that were deferred from calendar year 2020. But even adjusting for those effects, revenue growth was very strong. The sources of that growth will not be well understood until information from tax returns becomes available, but it seems reasonable to expect that the rapid run-up in the stock market and other equity prices in 2021 substantially boosted capital gains realizations and other related incomes; those effects often get reflected in federal revenues when taxpayers file their income tax returns in the subsequent year. Continued economic recovery from the 2020 recession clearly also contributed, as has wage and other income gains (including corporate profits) from increasing inflation. Indexation for inflation of the individual income tax brackets and other tax parameters occurs with a lag, so the recent jump in inflation can temporarily boost average tax rates.

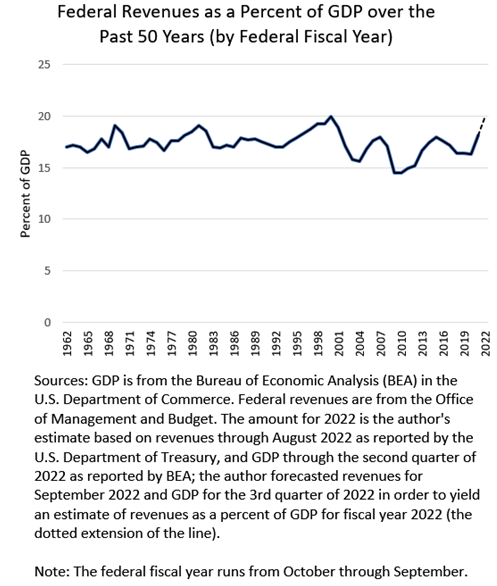

Combining our expectation for revenues in September with our projection of nominal GDP for the third calendar quarter, which is based on our interpretation of a survey of economic forecasts compiled by the Philadelphia Federal Reserve, we expect that federal revenues for the year will measure about 19.8 percent of GDP (see the chart below); that amount would be higher than in any year except in 2000 and 1944. It would also represent a rapid increase from amounts over the 2018-2020 period, when revenues measured between 16.3 percent and 16.4 percent of GDP each year. Note that GDP can be revised, sometimes substantially, and major annual revisions to GDP and the components are being made late this month. If GDP for 2022 is revised substantially, then revenues measured relative to GDP would be affected. Also, the measures of gross domestic product (GDP) and gross domestic income (GDI) are supposed to be equal, measuring the size of the overall economy in different ways, but a difference between the two measures always exists–and it has been a particularly large difference recently. That suggests that a higher-than-normal probability exists for substantial revisions to GDP for 2022, either made later this month or next year or even later. Nonetheless, it is difficult to expect anything but a fiscal year with rapid revenue growth and a historically-high amount of revenues relative to GDP.