Posted on June 12, 2020

Summary

- Tax withholding continued to move up slightly in the first half of June, as the recent sharp declines in withholding have moderated somewhat since late April.

- The improvement in withholding suggests that economywide wages and salaries have moved up from their levels at the worst of the downturn, although they have a long way to go to get back to pre-pandemic levels.

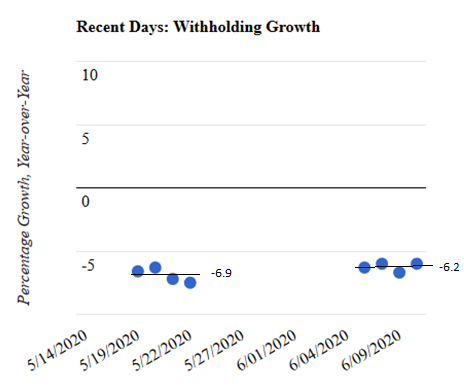

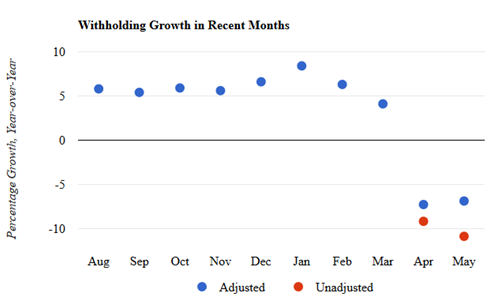

We’ve seen a slight improvement in daily tax withholding in the first half of June. We estimate that remittances to the Treasury of tax withholding in the first half of June, compared to the amount in the first half of June of a year ago (measuring so-called year-over-year growth), was down by 6.2 percent, just slightly better than the 6.9 percent decline recorded in the second half of May (see chart below). That small improvement suggests that economywide wages and salaries have picked up slightly, although given the variability in withholding growth, the modest improvement could just be statistical noise. For the second half of April, so a month and a half ago, we estimate that withholding was down by 7.3 percent on a year-over-year basis; so, there is evidence of a trend toward improvement in the recent data, but there is still a long way to go for withholding to get back to the 6 percent growth measured over most months from July of last year to this past February. All of those withholding growth estimates remove the estimated effect of recent law changes to allow for a comparison to wage changes.

The May employment report from the Bureau of Labor Statistics (BLS), released a week ago, had a rather substantial improvement in employment and wages, while the withholding data suggest a more tempered wage improvement. According to the BLS data, economywide private sector wages fell by 6.0 percent in May (year-over-year), a substantial improvement from the 8.8 percent year-over-year decline in April. For a proxy measure of wage growth, we use withholding growth, after adjustment for the estimated effect of tax law changes (see latest legislative estimates). We measure that withholding on the adjusted basis fell by 7.3 percent year-over-year in April, and that performance improved just slightly to a 6.9 percent decline in May (see chart below). We consider that to be more of a sideways movement than a significant increase. Nonetheless, the movement in the first part of June suggests more of an improvement and at least movement in the right direction.

We’ll see if the withholding data for the second half of June continue to show some improvement as states have continued to relax their coronavirus-related restrictions. In part as a result of the holdover calendar effects of the Memorial Day holiday, we only get three daily measurements of withholding in the second half of this month (see methodology). We are now entering the period in the middle of the month in which we cannot get reliable daily measurements of withholding growth because of volatile mid-month withholding remittances that are highly affected by the calendar. Our next measurement of withholding growth occurs a week from today, for activity through the previous day, Thursday the 18th.