Posted on December 6, 2023

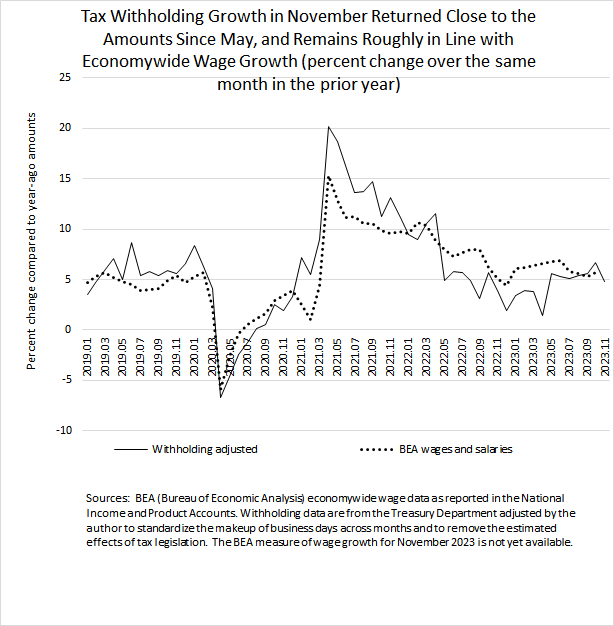

We estimate that federal tax withholding–the amount of income and payroll taxes withheld from workers’ paychecks and remitted daily to the U.S. Treasury–grew by 4.8 percent in November (compared to the amount from November of a year ago). After temporarily increasing by 6.7 percent in October, growth in November represents a return to just about the average growth from May through September of this year, when we estimate that withholding grew by between 5.1 percent and 5.6 percent each month (see chart below). So, we see no signs of significant changes in overall economic activity, like a slowdown or acceleration, from the withholding data. The temporary increase in withholding growth in October probably resulted from disaster-related payment delays (see previous post). Our measure of withholding growth adjusts the actual amount of withholding to remove the estimated effects of tax law changes (with no such adjustments needed this year) and to standardize the calendar across months.

Tax withholding in recent months has been roughly tracking recently-available data on economywide wages and salaries (again see the chart below). The data on economywide wages and salaries from the Bureau of Economic Analysis are not yet available for November, but we don’t expect any significant shifts.